About Investment Property Loans

A hard money loan for an investment property is a private loan made to a real estate investor for the purpose of purchasing or refinancing a rental home or other income-earning real estate asset. These types of loans are always secured by the investment property itself, generally by a deed of trust. These loans are typically made for a longer term than an average hard money loan but may also carry a lower rate of interest than shorter-term loans. Investors who take these types of loans are generally unable to receive a traditional bank loan or must close quickly and are therefore willing to pay a higher rate of interest and/or contribute more cash at closing than with a traditional bank loan. Due to the higher rate of interest, the borrower will often intend to refinance the loan at a lower rate at some point in the future.

Top Cities

- Houston, TX

- Chicago, IL

- Brooklyn, NY

- Los Angeles, CA

- Miami, FL

- San Antonio, TX

- New York, NY

- Philadelphia, PA

- Las Vegas, NV

- Bronx, NY

- Phoenix, AZ

- Dallas, TX

- San Diego, CA

- Minneapolis, MN

- San Jose, CA

- Denver, CO

- Austin, TX

- St Louis, MO

- Indianapolis, IN

- Atlanta, GA

- Tucson, AZ

- Orlando, FL

- Portland, OR

- Seattle, WA

- Fort Worth, TX

- Jacksonville, FL

- Milwaukee, WI

- San Francisco, CA

- Cincinnati, OH

- Charlotte, NC

- Columbus, OH

- Cleveland, OH

- Fort Lauderdale, FL

- Sacramento, CA

- St Paul, MN

- El Paso, TX

- Louisville, KY

- Tampa, FL

- Memphis, TN

- Pittsburgh, PA

- Detroit, MI

- Albuquerque, NM

- Oklahoma City, OK

- Baltimore, MD

- Washington DC, DC

- Salt Lake City, UT

- Fresno, CA

- Buffalo, NY

What Is An Investment Property Loan?

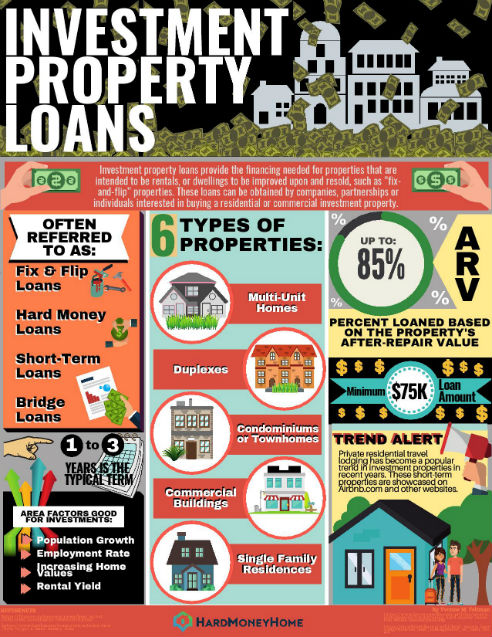

Companies, partnerships or individuals interested in purchasing a residential or commercial investment property will require funding in the form of a loan. Investment property loans provide the financing needed for properties that are intended to be rental properties, or properties to be improved upon and resold, such as "fix-and-flip" properties. Typically, the loans used for these investments are short-term, known as hard-money loans, fix and flip loans or bridge loans.

These properties cannot be owner-occupied, but in instances where there is a multi-unit property, the owner may be able to live in one of the units and still qualify for the loan financing.

How Do Investment Property Loans Work?

The residential or commercial property is the collateral in an investment property loan. The lender finances the purchase of the property and the improvements or remodeling, if needed. The amount of financing depends on the lender's loan-to-value requirements. Hard money lenders will lend up to 85 percent of the property's estimated after-repair value (ARV). In contrast, if a bank is the lender, the property's current market value, and not improvements, will determine the amount the bank will lend.

Once a property is selected, the lender will review the price, the amount the borrower plans to invest in improvements and the estimated value of the property after improvements or repairs are made. The lender will offer a loan within its loan-to-value limits, specifying an interest rate and repayment period. In some cases, the loan may be divided into tranches, or separate transactions, one for the property purchase and one or more for the property repair and rehab. The borrower agrees to allow the lender to place a lien on the property, allowing the lender to seize the property in case of borrower's failure to make agreed loan payments.

For fix and flip investment loans, the borrower can repay the loan once the property is improved and sold. For investment properties to be repaired and rented out, a conventional (traditional) mortgage loan will replace the shorter higher-interest hard money or bridge loan.

What Are Common Types of Investment Properties?

- Single-family homes

- Multi-unit homes

- Duplexes or split residences

- Condominiums

- Commercial Building

Another type of investment property that is gaining in popularity is private residential travel lodging or homestays. These properties are purchased with the intent to rent out all or part of the property daily, weekly or monthly as accommodation for visiting travelers. Popular travel booking websites such as HomeAway.com and Airbnb.com showcase these short-term, privately owned rental properties.

How Do I Qualify For An Investment Property Loan?

Bank loans require excellent credit in order to offer a low interest rate rate, but great credit is not necessary for a hard-money loan. A cash contribution of 20 to 40 percent of the property or project costs will need to be supplied by the borrower.

Financial records such as bank, retirement and investment statements, pay stubs, driver's license, social security card and other documentation depending on marital status is required. For those who are self-employed, two years of past tax return statements and business banking statements may be required.

In addition, a business plan for the project, including a budget for renovation costs, title statements and property assessments may have to be included. Banks require extensive paperwork, while hard money lenders require less.

Where Do I Get an Investment Property Loan?

Hard money lenders and bank loans are the go-to sources for investment property loans.

Local banks, credit unions and large nationwide banks offer property loans to investors. For those seeking hard money loans, they can be obtained from hundreds of private financial firms both small and large. Many of these lenders can be found locally or online by the click of a mouse, but it is important to research for complaints and compliance.

Sometimes the existing property owner may be able to provide financing for the investment, or fix and flip deal.

Another place to obtain a loan is through an existing mortgage. If you are a current homeowner who has built up enough equity in your home, a home equity loan or line of credit (HELOC) can allow you to borrow up to 80 percent of the equity value against your primary residence. Being that your primary residence is used as the collateral in this transaction, it can be a more risky way to secure financing for those who are inexperienced property investors.

Example of an Investment Property Loan Scenario:

Brad and Jennifer are a young professional couple wanting to increase their savings account. They stumble upon a foreclosed condominium home for sale that they feel would be a good fix-and-flip project. The property was last purchased for $195,000, but the bank is willing to sell for $115,000. Joe and Betty believe that a $35,000 investment will create a property that will sell for $195,000 after repairs. A hard money lender agrees with their ARV estimate and is willing to lend them 70%, or $136,500. Jennifer and Brad use the loan proceeds to purchase the home and pay for half the rehab. They allow the lender to put a lien on the property and they contribute $19,500 to complete the project. If the property goes on the market and sells for $195,000 or more, they will clear a profit of $39,000, which is a 200% return on their $19,500 contribution.

Loans To Pay For An Investment Property

Hard Money Loan

A hard money loan is a short-term loan secured by an asset such as real estate. Hard Money lenders are usually private investors, or a fund of investors. The interest rate is higher than traditional long-term bank loans and the repayment period is typically 2-5 years.

Bank Loan

Bank-issued loans for terms of 15 to 30 years can be used to purchase long-term non-owner-occupied investment properties in good condition. These loans offer lower interest rates than hard money private lenders.

Government sponsored lender Fannie Mae, offers a HomeStyle Renovation Mortgage for single-family one-unit investment properties, units in condos, co-ops, mobile homes and planned unit developments (PUDs). Any renovation or repair is eligible, as long as it is permanently affixed to the property and completed within a year of the loan issue.

Refinance / Cash Out

This occurs when a property the borrower already owns is refinanced to finance the purchase of a new investment property. The new loan issued is considered a "first lien." This means that the original mortgage must be paid in full prior to receiving access to the equity accumulated. The difference between old loan and the new refinanced one is the cash the investor can use to finance improvement projects or property investments. This cash has no restrictions and can be spent on an owner occupied residence as well as an investment property or rental (up to four units).

Other Loans

In some cases the party selling a property can offer a loan to the buyer. Other non-conventional ways of funding an investment loan is by partnering with someone who has the cash, receiving a loan from friends or family, borrowing from a retirement account or 401k, taking out a personal or business loan or home equity loan or line of credit (HELOC).

Hard Money Loans vs Bank Loans

A good credit score is more important for securing bank loans. Hard money lenders place more importance on the property value.

It takes less than a week typically to secure a hard money loan since the property value is evaluated more than the buyer's credit or financial history. In contrast, a bank loan usually takes a few weeks to process since banks extensively investigate the credit and financial state of the borrower.

Banks typically base their 80 percent loan-to-value ratio on the property's value prior to improvements. The opposite is true for hard money lenders, who offer a lower loan-to-vale ratio, but it is based on the estimated value of the home after repairs are made. This hard money loan amount can result in a higher loan amount than what a bank will offer.

Interest rates are lower when issued from a bank, depending on the borrowers credit score. Hard money home loans typically come with higher interest rates. For this reason, most borrowers only use hard money loans for a short duration even though they can be used longer term.

Hard Money Loan vs Bridge Loan

A bridge loan often finances a property that may be in transition and does not yet qualify for traditional financing. Bridge loans are short-term loans used until other permanent or traditional bank-loan financing can be secured. A bridge loan allows the borrower to fulfill current obligations or property rehabilitation by providing immediate cash flow.

Similar to hard money loans, these loans have higher interest rates and are usually backed by some form of collateral, such as real estate. These loans can be issued through a bank or privately and the term is a few weeks, up to one year.

Recent Topics

View All

Legitimate vs Predatory Lenders

Anytime a borrower seeks out alternative or special financing, like a hard money loan, it is extremely important to do the homework. Everyone considering a hard money loan should know what to expect, how to evaluate the options presented and what kinds of documentation will be expected at closing. ...

Read More

Types of Private Money Loans

Many property buyers look for alternatives to the big bank loan process that can take a long time to fund and often require excessive paperwork. There are many different types of special financing available. This is a short overview of some of the options US buyers have today. Hard money refers to...

Read More

Documents in a Hard Money Loan

While hard money loans are known for funding faster than more traditional mortgage loans and they often require much less paperwork, there is still some paperwork and there will be a closing. It's a good idea to prepare, going in with an understanding of what will happen and what kinds of documents...

Read MoreView By State

- Alaska

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Connecticut

- Washington DC

- Delaware

- Florida

- Georgia

- Hawaii

- Iowa

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maryland

- Maine

- Michigan

- Minnesota

- Missouri

- Mississippi

- Montana

- North Carolina

- North Dakota

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- Nevada

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Vermont

- Washington

- Wisconsin

- West Virginia

- Wyoming

Your Information is Processing

Your Information is Processing