About Hard Money Construction Loans

New construction hard money loans are asset-backed loans collateralized by real estate. The builder who takes out such a loan is typically unable to secure a conventional loan from a bank, a common issue in today's construction market. For that reason, he or she is generally willing to pay a higher rate of interest to a private money lender in order to close the transaction. Construction loans often include funds for purchasing raw land as well as for building costs, which are paid out in periodic "draws" once the builder has met some pre-defined milestones. Due to the higher risk associated with these types of loans, the lender will generally require the borrower to contribute some of their own cash or equity to the deal. Additionally, borrowers will often have input into the project plans, particularly relating to the timelines and budgets.

Top Cities

- Houston, TX

- Chicago, IL

- Brooklyn, NY

- Los Angeles, CA

- Miami, FL

- San Antonio, TX

- New York, NY

- Philadelphia, PA

- Las Vegas, NV

- Bronx, NY

- Phoenix, AZ

- Dallas, TX

- San Diego, CA

- Minneapolis, MN

- San Jose, CA

- Denver, CO

- Austin, TX

- St Louis, MO

- Indianapolis, IN

- Atlanta, GA

- Tucson, AZ

- Orlando, FL

- Portland, OR

- Seattle, WA

- Fort Worth, TX

- Jacksonville, FL

- Milwaukee, WI

- San Francisco, CA

- Cincinnati, OH

- Charlotte, NC

- Columbus, OH

- Cleveland, OH

- Fort Lauderdale, FL

- Sacramento, CA

- St Paul, MN

- El Paso, TX

- Louisville, KY

- Tampa, FL

- Memphis, TN

- Pittsburgh, PA

- Detroit, MI

- Albuquerque, NM

- Oklahoma City, OK

- Baltimore, MD

- Washington DC, DC

- Salt Lake City, UT

- Fresno, CA

- Buffalo, NY

What Is A Hard Money Construction Loan?

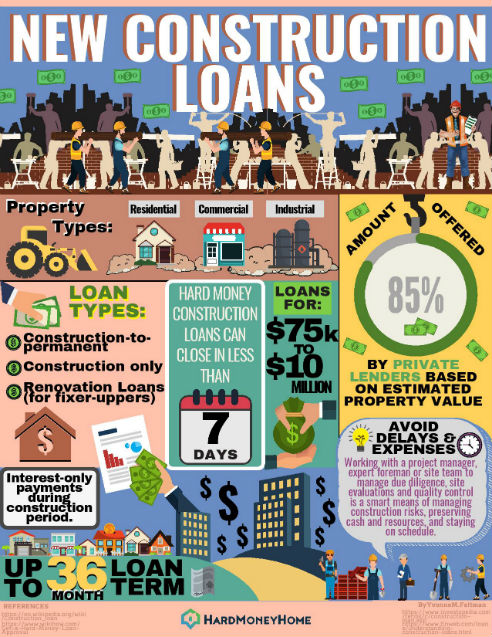

Hard money construction loans are for those who need the funds to get their new construction project started but may not be a good fit for a loan from a traditional lender. Construction loans are typically used to finance the renovation, or new construction of residential or commercial real estate.

The most popular new construction loans are conventional bank loans, hard money private loans and SBA loans for commercial real estate. Usually construction loans are higher interest, and shorter term loans. Unlike a traditional home loan, which is based on the fair market value of the home and determined by the home's condition in comparison to other recent sales, construction loans are based on what the projected value of the residential or commercial property will be once the work is complete.

Main Types of Constructions Loans

Construction-to-permanent loans. These loans are good if you have definite construction plans and timelines in place. In this case, the bank pays the builder as the work is being completed. Then, that cost is converted to a mortgage at closing. This type of loan allows you to lock interest rates at closing, which makes for steady long-term payments.

Construction-only loans. Construction-only loans must be paid off in full once the building is complete. It's a good choice if you have a large amount of cash to work with or you're confident that the proceeds from the sale of a current property will cover another build. Here, if you need a mortgage to cover the cost, you'll have to search for the lender yourself and be approved a second time.

Renovation construction loans. This type of loan is used if you're buying a fixer-upper. In this case, government programs are available and the projected cost of any renovations you plan on doing to the property is wrapped up in the mortgage, along with the purchase price.

New construction loans are usually long term loans aimed at spacing out the total cost to build or buy new construction units over a span of 5 to 25 years.

Hard money construction loans typically last no more than a few years.

Traditional Construction Loans vs Hard Money Construction Loans

Traditional construction loans are issued by banks typically, hard money loans can be obtained through private investment firms. Hard money construction loans are secured by the real estate to be built and often charge higher interest rates conventional bank loans.

Builders, investors and developers with a strong financial background and access to traditional loans still opt for hard money loans to fund their new construction projects because the hard money loan process is faster and easier in most cases. Hard money constructions loans can close in less than a week, whereas bank closings can take 30 days or more.

Specifically, the application process for a hard money construction loan can take a couple days and the approval process can take up to a week. Those desiring to get a project kicked off, or those on a tight timeline will benefit from this swift financing window. In contrast, conventional construction loans can require extensive paperwork that can cause the application process to last weeks. This doesn't include the loan processing period which can take another few weeks or longer till closing.

What Type of Construction Projects Could Use Hard Money?

There are several different types of new construction projects that would benefit from access to hard money. These projects are initiated by individuals, homeowners, corporations, other business entities, non-profit associations, privately funded schools, hospitals, publicly traded companies, etc.

Construction projects come in all different shapes and sizes, and include:

Residential Construction. Construction work that is being performed on a single-family residence or a residential dwelling with less than 4 units. Apartment and condominium complexes would most likely be considered a commercial project unless it only consists of a few units and the owner occupies one.

Commercial Construction. This is the construction of any buildings or structures for commercial purposes, including restaurants, grocery stores, high-rises, shopping centers, sports facilities, hospitals, schools, etc.

Industrial Construction. This is a niche segment of the construction industry. These projects include power plants, manufacturing plants, solar wind farms, refineries, etc.

Where To Get Hard Money Construction Loans

Many novice and experienced in construction projects will turn to hard money lenders as the go-to for fast money. New construction hard money loans can be obtained from hundreds of private financial firms both small and large. Many of these lenders can be found locally or online by the click of a mouse, but it is important to research for complaints and compliance.

Many firms have close relationships with the most active commercial property construction lenders in the market and are prepared to arrange direct access to them as the shortest, most effective route to closing a deal. In addition, there are a variety of private investor and hard money crowdfunding platforms online where multiple investors pool their money to finance various residential and business projects from the ground up.

In come cases, the existing property or land owner (ie: tear-down and rebuilds) may be able to provide financing for the new construction deal.

Hard Money Construction Loan Terms

Loan terms can vary depending on each project and hard money lender but typically the loan terms for construction & development typically consist of the following:

- Up to 75 percent loan to value ratio on commercial construction loans

- Up to 85 percent loan to value ratio on residential construction loans

- Up to 85 percent with a mezzanine loan or preferred equity

- Up to 36 months loan term

- With provisions to roll into a permanent mortgage

- Non-recourse construction loans available on business loans

- Fixed interest rate

Hard money commercial lenders typically allow the seller to carry back a second mortgage. Any lender will want to make sure that the borrowers are also prepared to put some financial backing into the project as well. By having cash readily available as backing shows the lender that the construction project is serious enough to risk a down payment to get the loan needed to complete the job.

Interest-Only Payments

Many short-term construction loans require interest-only payments for the duration of the loan, during the construction period. To calculate an interest only payment, take the construction loan amount multiplied by the interest rate, divided by 12 (months per year). For Example: $600,000 loan amount at 10%. $600,000 multiplied by .10 and divided by 12 = $5,000 per month as the monthly payment.

Beware of Unexpected Construction Expenses

From sudden increases in the cost of materials during construction to environmental and structural issues like unsuitable soil, infestations, hazardous conditions or other issues discovered along the way, unwelcome surprises during a construction process can increase expenses and threaten adherence to a schedule.

Due diligence activities at the front-end of the design phase, such as a Phase 1 Environmental Site Assessment, a Geotechnical Site Investigation and builder inspections can help to identify potential issues early in the project so they can be resolved or avoided from a budget and schedule standpoint. Employing a design-contractor team to manage these due diligence items is a smart means of managing project risks and preserving cash resources.

Recent Topics

View All

Types of Foreclosure

In the United States, there are generally two kinds of foreclosure processes to consider, judicial foreclosure and non-judicial foreclosure. States typically make the rules about which type will be in play on a given property but in some states both types are possible so it is important to understan...

Read More

5 Steps in Obtaining a Hard Money Loan

It may seem obvious, but nobody just googles the term "hard money loan" and gets the money they need for a home or remodel. There is a process to follow, as with any loan. The fact that hard money loans are faster and require less paperwork than a standard mortgage from big banks does not mean that...

Read More

Documents in a Hard Money Loan

While hard money loans are known for funding faster than more traditional mortgage loans and they often require much less paperwork, there is still some paperwork and there will be a closing. It's a good idea to prepare, going in with an understanding of what will happen and what kinds of documents...

Read MoreView By State

- Alaska

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Connecticut

- Washington DC

- Delaware

- Florida

- Georgia

- Hawaii

- Iowa

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maryland

- Maine

- Michigan

- Minnesota

- Missouri

- Mississippi

- Montana

- North Carolina

- North Dakota

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- Nevada

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Vermont

- Washington

- Wisconsin

- West Virginia

- Wyoming

Your Information is Processing

Your Information is Processing