About Hard Money Refinancing

"Hard money" refinancing refers to a specific type of loan that is secured by real estate. This type of loan is typically taken by individuals or businesses who need to quickly get cash out of equity in a property but who cannot easily obtain a traditional loan with a bank or credit union. Lenders who offer this type of asset-backed refinancing tend to charge higher interest rates and fees than banks and generally offer lower "loan-to-value" ratios (the percentage of the property's value vs. the amount of the loan). This is due to the speed and convenience of the loan as well as to account for the higher risk associated with borrowers who have lower credit ratings. Common reasons for taking a cash-out hard money loan are buying out a business partner, purchasing equipment or working capital, or making payroll.

Top Cities

- Houston, TX

- Chicago, IL

- Brooklyn, NY

- Los Angeles, CA

- Miami, FL

- San Antonio, TX

- New York, NY

- Philadelphia, PA

- Las Vegas, NV

- Bronx, NY

- Phoenix, AZ

- Dallas, TX

- San Diego, CA

- Minneapolis, MN

- San Jose, CA

- Denver, CO

- Austin, TX

- St Louis, MO

- Indianapolis, IN

- Atlanta, GA

- Tucson, AZ

- Orlando, FL

- Portland, OR

- Seattle, WA

- Fort Worth, TX

- Jacksonville, FL

- Milwaukee, WI

- San Francisco, CA

- Cincinnati, OH

- Charlotte, NC

- Columbus, OH

- Cleveland, OH

- Fort Lauderdale, FL

- Sacramento, CA

- St Paul, MN

- El Paso, TX

- Louisville, KY

- Tampa, FL

- Memphis, TN

- Pittsburgh, PA

- Detroit, MI

- Albuquerque, NM

- Oklahoma City, OK

- Baltimore, MD

- Washington DC, DC

- Salt Lake City, UT

- Fresno, CA

- Buffalo, NY

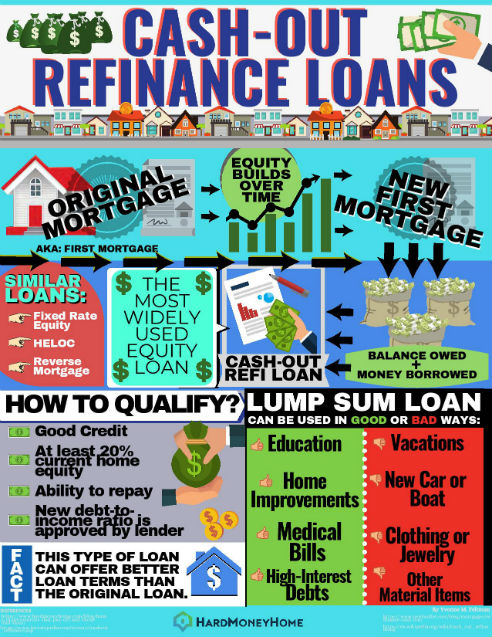

What is a Cash-Out Refinance Loan?

Cash-out refinancing, or a cash-out refi loan, is a way to refinance your existing mortgage and borrow cash at the same time. This results in a higher balance owed on your new mortgage including the closing costs rolled into the loan plus the amount of cash you receive. This new mortgage essentially pays off an existing loan and replaces it with a new loan for a larger amount.

Not only can this type of loan transaction turn equity into ready cash, it can offer better terms than that of the original loan. Depending on the real estate climate and financial health of the borrowers, a new mortgage could come with a lower interest rate or shorter payment terms. In addition, the type of mortgage could change to a fixed-rate mortgage versus an adjustable-rate loan, etc.

Because a cash-out refinance leads to the creation of a new loan, it includes all the origination and closing costs that accompany a typical mortgage. As with any typical home mortgage, the property owners pay interest for the life of the loan. The new "first" loan that is created can come from the borrowers original mortgage lender or from a new lender.

Cash-Out Refinance Loan AKA: Home Equity Loans

Terms used interchangeably and falling under the blanket category of home equity loans include:

- Home equity line of credit (HELOC)

- Fixed-rate home equity loans

- Cash-out refinancing loans

- Reverse Mortgages (for owner-occupied borrowers over age 62)

All of these vary slightly from one another, but basically, they all allow a homeowner to tap into home equity by using their house as collateral for cash. For cash-out refinancing, that cash typically comes as a lump sum, fixed-rate loan paid in one transaction. The borrower pays back the loan plus interest over time. Or in the case of a home equity line of credit, the loan functions as revolving debt.

The cash-out refinancing option is the most widely used home equity loan due to lower fees and a fixed-rate.

Example of a Cash-Out Refinance

Perhaps home values have increased in your area over the last several years and your house is worth $300,000 but your mortgage only has a $125,000 currently as the balance. By refinancing your mortgage, you can get a lower interest rate and make some remodeling, repairs and upgrades to your existing residence. If you determined that you need $45,000 for your home improvements, then you could refinance into a new loan of $170,000 which would include the starting balance plus the cash you pulled out for your project ($125k plus $45k).

Another scenario for cash-out refinancing: You have been a homeowner for about 10 years and the original mortgage interest rate you got was just over 6 percent. Now you own more equity in your home and have an improved credit score as well. In this case, you might be able to refinance to a mortgage with a 4% interest rate while also taking out cash, if needed.

Using the Cash in a Cash-Out Refinance

While the cash you receive in the refinancing process doesn't have to be used for home improvements, it is advisable to do so to further increase home value. Other ways people use the cash include, higher education, business expenses or investments, and consolidating debt.

Sometimes it makes sense to invest in tuition for an education program to learn new skills or earn qualifications that will increase income or earning potential. For instance, earning an MBA to get a promotion or raise can financially pay off over the long haul. Education is typically considered a smart way to spend cash-out dollars.

Earning capital to start a business venture or investment can be difficult, so a cash-out can be a good way to produce the funding needed. However, this is a risky way to use the money considering many young businesses fail. Extensively evaluating the market and having a business plan, and a fail plan is imperative.

Many people will decide to pay off medical debt or high interest credit card debts with a cash-out refinance loan. This can be a smart way to reduce the interest paid. However, unlike credit card creditors who cannot seize your home if you fail to pay, mortgage lenders can and will use your home as collateral if you fail to pay the loan.

Buying a car, going on a nice vacation, or using the cash for other material items that do not appreciate in value is not a wise way to use cash-out refinance funds.

Cash-Out Refinance vs HELOC

The refinanced loan cash-out is provided in a lump sum via a bank wire, or check. The money can be spent however you wish, without restrictions. Because a cash-out refinance requires the borrower to take out a new first mortgage, the closing costs are often higher than with a home equity loan or a HELOC.

Interest rates for first mortgages are typically lower than for HELOC or home equity loans. A refinance extends the loan term, for years, sometimes decades past the original mortgage period. This can create an unplanned financial obligation, like delaying relocation or retirement.

Interest rates on a HELOC will fluctuate with market rates, which means that rates could increase over time, unlike a fixed-rate loan.

There are usually little-to-no fees when opening up a HELOC. In some cases, if a refinancing deal causes the home equity to dip to less than 20 percent, private mortgage insurance may be required.

First Mortgages vs Second Mortgages

Some confuse a cash-out refinance loan as a second mortgage, but they are not the same. Traditional mortgages are often referred to as "first mortgages" and home equity loans referred to as "second mortgages." In both cases, a bank loans money to the borrower using property as collateral. Both also require a review of the borrower's financial situation to determine a loan rate, and both options come with a similar fees.

In contrast, second mortgages or home equity loans come with higher interest rates. This is because second mortgages are considered riskier to the lender. If a borrower stops making payments, the original mortgage would be reimbursed first in the event of foreclosure and sale of the property. The second mortgage would only be reimbursed with what is left over, if anything.

In the case of cash-out refinancing, you're not taking out a second mortgage--you're getting a new first mortgage. This makes it less risky, and more straightforward.

How to Qualify for a Cash-Out Refinance

Similar to a conventional mortgage loan, the qualifications are the same for a cash-out refinance loan. Property owners who meet the following criteria may qualify:

- Good credit score

- 20 percent or higher of existing home equity

- Ability to repay the loan

- The new debt-to-income ratio is acceptable to the lender

It is easy to research lenders online and compare rates and fees. In addition, there are mortgage calculator tools and tips to aid you in the process of a cash-out refinance.

Once you determine your credit score and gather all of your paperwork, you will need to have cash on hand. There are likely to be property taxes and insurance, closing costs and other expenses to pay. These expenses are listed in the loan refinance estimate so it shouldn't be a surprise. These costs can sometimes be rolled into the mortgage balance, which can reduce upfront costs, but increase the outstanding balance and monthly payments.

Recent Topics

View All

Legitimate vs Predatory Lenders

Anytime a borrower seeks out alternative or special financing, like a hard money loan, it is extremely important to do the homework. Everyone considering a hard money loan should know what to expect, how to evaluate the options presented and what kinds of documentation will be expected at closing. ...

Read More

Types of Private Money Loans

Many property buyers look for alternatives to the big bank loan process that can take a long time to fund and often require excessive paperwork. There are many different types of special financing available. This is a short overview of some of the options US buyers have today. Hard money refers to...

Read More

Documents in a Hard Money Loan

While hard money loans are known for funding faster than more traditional mortgage loans and they often require much less paperwork, there is still some paperwork and there will be a closing. It's a good idea to prepare, going in with an understanding of what will happen and what kinds of documents...

Read MoreView By State

- Alaska

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Connecticut

- Washington DC

- Delaware

- Florida

- Georgia

- Hawaii

- Iowa

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maryland

- Maine

- Michigan

- Minnesota

- Missouri

- Mississippi

- Montana

- North Carolina

- North Dakota

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- Nevada

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Vermont

- Washington

- Wisconsin

- West Virginia

- Wyoming

Your Information is Processing

Your Information is Processing