About Bridge Loans

Bridge loans are short-term loans that "bridge" the gap between a real estate transaction and the closing of conventional financing or some other type of financial transaction. This type of loan is most commonly used in commercial applications where a business needs to obtain cash quickly but cannot close a loan with a bank for some period of time. In this scenario, they may use a bridge loan for a period ranging from a few days to a few months until they can secure conventional financing through a bank or credit union.

Borrowers who seek these temporary loans from private lenders generally must pay a premium interest rate and additional points and/or fees for the convenience, and will also be expected to put property (usually real estate or machinery) up as collateral in the deal. Some lenders may also issue loans backed by inventory, accounts receivable, or even a simple personal guarantee of the company principles.

Top Cities

- Houston, TX

- Chicago, IL

- Brooklyn, NY

- Los Angeles, CA

- Miami, FL

- San Antonio, TX

- New York, NY

- Philadelphia, PA

- Las Vegas, NV

- Bronx, NY

- Phoenix, AZ

- Dallas, TX

- San Diego, CA

- Minneapolis, MN

- San Jose, CA

- Denver, CO

- Austin, TX

- St Louis, MO

- Indianapolis, IN

- Atlanta, GA

- Tucson, AZ

- Orlando, FL

- Portland, OR

- Seattle, WA

- Fort Worth, TX

- Jacksonville, FL

- Milwaukee, WI

- San Francisco, CA

- Cincinnati, OH

- Charlotte, NC

- Columbus, OH

- Cleveland, OH

- Fort Lauderdale, FL

- Sacramento, CA

- St Paul, MN

- El Paso, TX

- Louisville, KY

- Tampa, FL

- Memphis, TN

- Pittsburgh, PA

- Detroit, MI

- Albuquerque, NM

- Oklahoma City, OK

- Baltimore, MD

- Washington DC, DC

- Salt Lake City, UT

- Fresno, CA

- Buffalo, NY

What Are Bridge Loans?

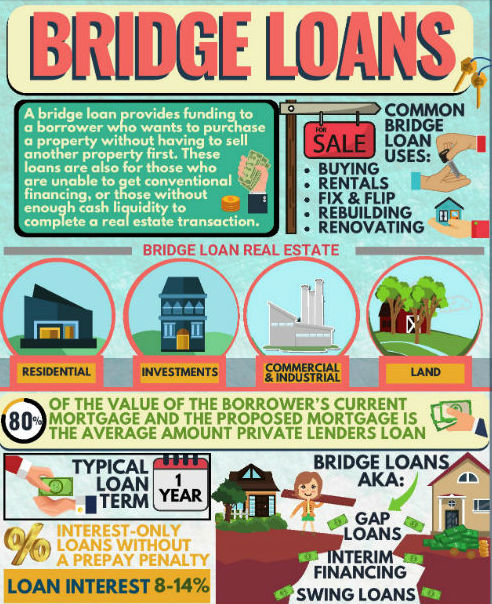

Also referred to as a swing loan, gap or interim financing, a bridge loan provides funding to a borrower who wants to purchase a property without having to sell another property first. This type of loan is a short-term "bridge" mortgage lasting up to a year, usually.

A bridge loan is ideal for buyers who prefer to finance the purchase or rehabilitation of their investment property rather than buy outright in cash. Bridge loans are sought when buying, renovating, or rebuilding residential properties. They are often referred to as fix-and-flip loans because the majority of those who take them out do so in order to repair, resell or rent.

Similar to home equity loans, and HELOCs, bridge loans are secured by the borrower's current home as collateral. Other loans that are similar to bridge loans include cash out or refinancing loans and fix and flip loans.

Who Uses Bridge Loans?

Typically a bridge loan is for borrowers with near term challenges, or those who are unable to secure conventional financing. Bridge loans are also perfect for buyers who have liquidity constraints. Here are some common situations where a bridge loan is used:

- Borrower is looking to purchase and sell different properties

- Borrower wants to acquire a new place to live without having to move into something temporary between buying and selling.

- Short term seasoning issues such as a foreclosure, short sale or project completion time

- Down payment challenges

- Divorce or probate situations

- Bridge loan financing instead of using cash or other assets (401K, investments, etc...) to avoid tax

- 1031 exchanges (defer capital gains tax)

- Reverse mortgage fallout

In these situations, most conventional lenders will not offer financing, so a bridge loan can be the best solution. These loans also help those who want to increase real estate investments by taking on one or more fix and flip projects at once.

What Are Bridge Loan Terms?

Closing on a hard money bridge loan can happen in less than a week, but up to a few weeks is typical. Generally, the terms include the following:

- 12-month maximum term

- No prepayment penalty

- 8 to 14 percent is the typical interest rate

- 2 to 3 points, varies by lender

Risks Involved in Bridge Loans

Using a bridge loan can be a great financial tool for real estate transactions, but there are risks involved as well. These include miscalculation in the cost to renovate or rebuild. Also, a borrower's profits may decrease if they overestimate the property's market value after repairs or rebuilding. There is also the fear that the borrower could overestimate demand after the property is built, failing to secure the funds necessary to avoid delaying repayment, or going into default.

The risk of payment-defaulting on a bridge loan is offset by multiple factors. These include the home equity of the borrower, the shorter terms of bridge loans, the customary borrowers' usual experience in flipping properties, and the constellation of interests between borrower and lender.

Borrowers with more equity in the property are less inclined to default on it, even if the property value drops. A borrower with greater knowledge and experience purchasing, renovating, and selling or renting properties is also considered less of a risk than a borrower with none. Also, because most bridge loans are short term, lenders are able to assess risks of falling home prices far more accurately.

Properties Suitable for Bridge Loans

Depending on the lender, various property types can be funded by a bridge loan, including:

- Residential

- Single-Family or Multi-Family

- Investment Property

- Commercial

- Industrial

- Land

Generally, loan-to-value ratios for residential property loans will be higher than other types of real estate.

Bridge Loan vs Hard Money Loan

Bridge loans secured by property are hard money loans, and hard money loans are considered to be short-term bridge loans, so the two are quite similar. A majority of those who use bridge loans do so in order to resell or rent, and to make a quick profit. The lenders of these short-term loans are typically small non-banking companies with a specialized knowledge of local real estate.

Bridge loan funds can be disbursed as a series of payments or in a lump sum, with different amounts tied to the property purchase and the renovation. These funds typically have a higher interest rate and last a few weeks up to one year. Hard money loan terms can go beyond a year, and can last several years if the situation requires.

A true bridge loan is solely for buying property, but a hard loan can be used for an array of purposes. Hard loans can be acquired rather quickly because private investors tend to be less picky than banks or lines of credit. This is also why a hard loan can make a great bridge loan.

Uniquely, a bridge loan can be used in reverse order by having the bridge loan secured against the new real estate which is being purchased, or by both the existing and new property.

Where to Get a Bridge Loan

Many banks and credit unions don't offer bridge loans because they prefer long-term loans. Bridge loan lenders are mostly private hard money lenders and investment firms. Though they offer higher interest rates and closing costs than conventional financing, hard money lenders are able to evaluate, approve and fund a bridge loan much quicker. If the property being used as collateral is an investment property, the hard money bridge loan can be approved and funded in under 5 days if needed.

If the property being used as collateral for the bridge loan is owner-occupied and the proceeds of the loan are being used to purchase a new owner-occupied property, it will be considered a consumer purpose loan. The lender must be licensed by the Nationwide Multi-state Licensing System (NMLS) in order to process and fund a consumer purpose loan.

If the property being used as collateral for the bridge loan is owner occupied but the proceeds of the loan are being used to purchase an investment property it would be considered a business purpose loan and an NMLS license would not be required.

How to Qualify for a Bridge Loan

Hard money lenders make qualifying for bridge loans relatively easy in comparison to other types of loans and lenders. An application is required to determine financial information about the borrower (income, assets, other real estate owned, existing debts, etc.) as well as basic information about the property. For investment properties there may be lease agreements and additional documentation required by the lender.

Once the application is completed, the borrower will need to have enough equity in their current home based on the requested loan amount as well as enough cash on hand to make the monthly payments during the bridge loan term.

The Ability to Repay Rule does not apply to bridge loans. Therefore, income documentation and debt to income ratio is not as important. As long as the borrower has sufficient equity, many hard money bridge loan lenders overlook bad credit and other negatives such as a history of loan modifications, short sales, foreclosures, a deed in lieu or bankruptcies.

Recent Topics

View All

5 Steps in Obtaining a Hard Money Loan

It may seem obvious, but nobody just googles the term "hard money loan" and gets the money they need for a home or remodel. There is a process to follow, as with any loan. The fact that hard money loans are faster and require less paperwork than a standard mortgage from big banks does not mean that...

Read More

Legitimate vs Predatory Lenders

Anytime a borrower seeks out alternative or special financing, like a hard money loan, it is extremely important to do the homework. Everyone considering a hard money loan should know what to expect, how to evaluate the options presented and what kinds of documentation will be expected at closing. ...

Read More

Types of Private Money Loans

Many property buyers look for alternatives to the big bank loan process that can take a long time to fund and often require excessive paperwork. There are many different types of special financing available. This is a short overview of some of the options US buyers have today. Hard money refers to...

Read MoreView By State

- Alaska

- Alabama

- Arkansas

- Arizona

- California

- Colorado

- Connecticut

- Washington DC

- Delaware

- Florida

- Georgia

- Hawaii

- Iowa

- Idaho

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Massachusetts

- Maryland

- Maine

- Michigan

- Minnesota

- Missouri

- Mississippi

- Montana

- North Carolina

- North Dakota

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- Nevada

- New York

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Vermont

- Washington

- Wisconsin

- West Virginia

- Wyoming

Your Information is Processing

Your Information is Processing