Fix-and-flip loans are often described as fast, flexible, and designed for real estate investors. That description is accurate, but incomplete.

These loans can be powerful tools when used correctly. They can also become expensive mistakes when investors do not fully understand how they work, how lenders evaluate risk, or when alternative financing might be a better fit.

This guide explains how fix-and-flip loans work, what makes them different from traditional financing, and when they actually make sense for an investment project. The goal is not to push a loan, but to help investors make informed decisions before committing to one.

What Are Fix and Flip Loans Designed For?

Fix and flip loans are short-term, asset-based loans created for investors who plan to purchase, renovate, and resell a property within a relatively short time frame.

Unlike traditional mortgages, these loans are structured around the deal itself rather than the borrower’s long-term financial profile. Lenders focus heavily on the property, the renovation plan, and the projected resale value.

Fix and flip loans are commonly used to:

- Purchase distressed or undervalued properties

- Fund renovation or repair work

- Close quickly in competitive markets

- Bridge financing until resale

Because speed and flexibility are priorities, these loans are designed to move faster than conventional financing, often with fewer documentation requirements.

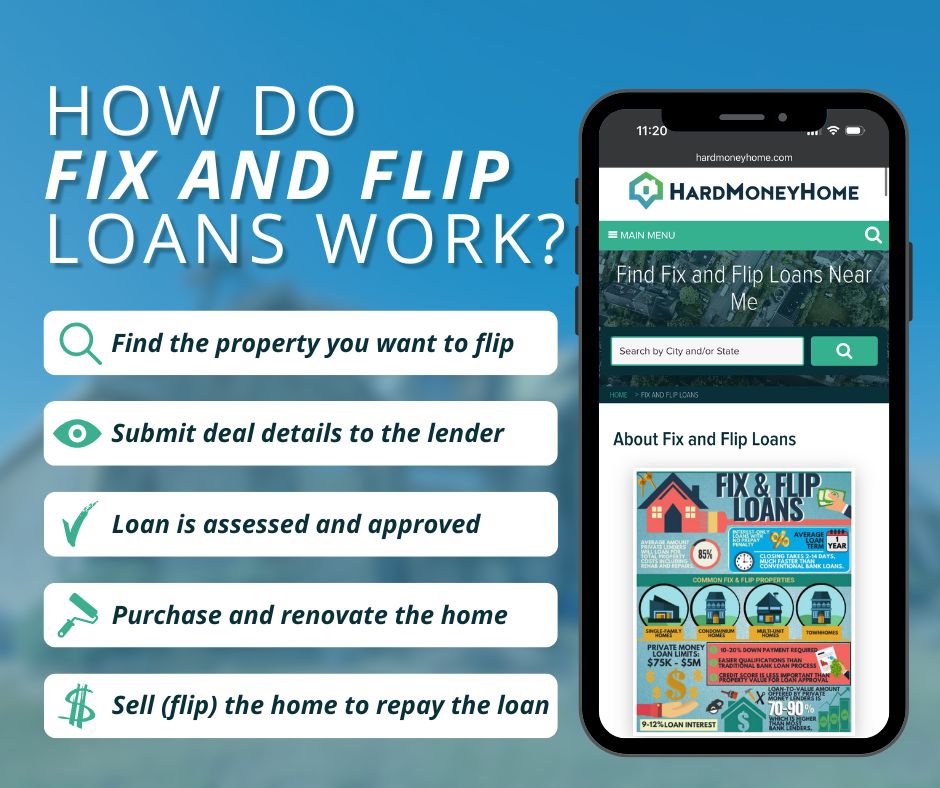

How Fix and Flip Loans Actually Work

A fix-and-flip loan typically combines purchase financing with renovation funding under a short-term structure. Instead of issuing one lump sum, lenders usually release renovation funds in stages based on completed work.

During underwriting, lenders evaluate several core factors:

- The purchase price of the property

- The estimated renovation budget

- The projected after-repair value, or ARV

- The investor’s experience level

- The proposed exit strategy

Loan terms often range from six to twelve months, though some lenders offer longer options. Renovation funds are commonly held in escrow and released through draw schedules after inspections confirm work completion.

Understanding this structure helps investors plan cash flow, contractor payments, and project timelines more realistically.

Why After-Repair Value Matters So Much

After-repair value plays a central role in fix-and-flip lending. Lenders use ARV to determine how much they are willing to lend and how much risk they are taking.

Most fix-and-flip loans are capped at a percentage of ARV rather than purchase price. This protects the lender if the project experiences delays, cost overruns, or market shifts.

For investors, ARV estimates must be conservative. Overestimating resale value is one of the fastest ways to erase profit, especially when carrying costs and interest continue to accrue.

Why Fix and Flip Loans Can Cost More Than Traditional Financing

Fix and flip loans are more expensive than conventional mortgages, and that difference is intentional. These loans involve higher risk, shorter terms, and faster funding.

Typical cost components include:

- Higher interest rates

- Origination or lender fees

- Short repayment timelines

- Ongoing carrying costs during renovation

While these costs can be justified by speed and opportunity, they must be accounted for in the deal analysis. A project with thin margins can quickly become unprofitable when financing costs are underestimated.

When Fix and Flip Loans Make Sense

Fix and flip loans are not designed for every investment. They tend to work best in situations where flexibility and speed matter more than long-term financing costs.

These loans often make sense when:

- A property needs significant renovation before it can qualify for traditional financing

- The home is being sold as-is and will not pass conventional loan requirements

- The investor needs to close quickly to secure the deal

- The resale timeline is relatively short and clearly defined

For example, an investor may find a distressed property that requires major repairs to the roof, electrical system, or plumbing.

Because of the condition, the home does not qualify for a conventional mortgage. A fix-and-flip loan allows the investor to purchase the property, complete the necessary renovations, and sell the home once it meets market and financing standards.

In competitive markets, this ability to move quickly can secure deals that would otherwise be lost. In those cases, the higher cost of financing may be offset by the opportunity to acquire and reposition the property.

When Fix and Flip Loans May Add Risk Instead of Value

There are also scenarios where fix-and-flip loans may introduce unnecessary risk.

They may not be ideal when:

- Renovation timelines are uncertain

- Profit margins are already narrow

- Market conditions are shifting

- The investor lacks renovation experience

Short-term financing amplifies both gains and losses. Without a clear plan and buffer, investors may face extension fees, refinancing challenges, or pressure to sell prematurely.

Common Misunderstandings About Fix and Flip Loans

Fix and flip loans are often misunderstood, especially by new investors.

Some common misconceptions include:

- Approval is guaranteed for any property

- Experience does not matter

- Renovation budgets are flexible

- Exit strategies can be adjusted later

In reality, lenders evaluate deals carefully. Unrealistic budgets, vague timelines, or weak exit plans often lead to declined applications or unfavorable terms.

Fix and Flip Loans Compared to Traditional Investment Financing

Understanding how fix-and-flip loans differ from traditional financing helps investors choose the right tool for each project.

|

Factor |

Fix and Flip Loans |

Traditional Financing |

|

Approval speed |

Faster |

Slower |

|

Primary focus |

Property and deal |

Borrower income and credit |

|

Loan term |

Short-term |

Long-term |

|

Cost |

Higher |

Lower |

|

Flexibility |

Greater |

More restrictive |

Each option serves a different purpose. The key is aligning financing with project goals.

Why Choosing the Right Lender Matters

Not all fix-and-flip lenders operate the same way. Terms, fees, draw schedules, and communication standards can vary significantly.

Working with the wrong lender can create delays, cash flow issues, or unexpected costs during renovation. This is why researching and comparing lenders is critical before committing.

HardMoneyHome provides investors with access to lender directories, reviews, and educational resources designed to support informed borrowing decisions.

Market Conditions Can Change the Equation

Market conditions influence both loan availability and investment risk. Interest rates, resale demand, and labor availability all affect how deals perform.

Investors should consider:

- Local resale demand

- Pricing trends

- Renovation labor constraints

- Sensitivity to holding costs

Fix and flip loans magnify the impact of market shifts. Understanding current conditions helps investors adjust expectations and strategies.

Exit Strategy Planning Is Not Optional

Every fix-and-flip loan needs a clear exit strategy before funding. While most lenders require one, investors should treat it as a core part of planning rather than a formality.

Common exit strategies include:

- Reselling the property after renovation

- Refinancing into long-term financing

- Selling to another investor

Each option carries different risks and timelines. Planning early reduces pressure and improves decision-making throughout the project.

When Fix and Flip Financing Requires Extra Due Diligence

Fix and flip loans are designed to move quickly, but speed does not remove risk. Certain deal scenarios call for a more careful review of both the loan structure and the lender offering it.

Extra due diligence is especially important when:

- Loan terms vary widely between lenders for the same project

- Fees, draw schedules, or extension costs are not clearly explained

- The projected profit depends on tight timelines or optimistic resale pricing

- Renovation costs are based on estimates rather than firm bids

- Market conditions are changing, or resale demand is uncertain

In these situations, the financing itself can influence whether a project succeeds or stalls. Small differences in interest rates, fee structures, or draw processes can significantly affect cash flow during renovation.

Taking time to compare lenders, review borrower experiences, and understand how different loan structures impact the deal helps investors avoid surprises after closing. The goal is not to slow progress unnecessarily, but to make sure speed does not come at the expense of clarity.

How HardMoneyHome Helps Investors Navigate Financing

HardMoneyHome is not a lender, but a research and education platform designed to help investors understand the private lending landscape.

The site offers:

- A large directory of hard money lenders

- Reviews and educational article

- Industry news and updates

- Tools to compare financing options

This information helps investors approach fix-and-flip loans with clarity instead of urgency.

Related FAQs You May Have

How much experience do lenders require for fix-and-flip loans?

Experience requirements vary, but lenders often adjust terms based on track record.

Can first-time investors use fix-and-flip loans?

Some lenders work with new investors, though terms may be more conservative.

What happens if renovations take longer than planned?

Delays can increase costs and may require loan extensions or refinancing.

How should investors compare lenders?

Evaluating terms, fees, flexibility, and reviews helps identify the right fit.

Conclusion

Fix and flip loans can be effective tools when used strategically. They offer speed and flexibility that traditional financing cannot, but they also introduce higher costs and tighter timelines.

Understanding how fix-and-flip loans work and when they make sense helps investors protect profit margins and reduce risk. With careful planning and informed research, these loans can support successful projects rather than create avoidable setbacks. Explore loans and lenders easily today.